Latest

Update

Today's Top Highlights

Explore the intersection of technology and creativity through storytelling in the digital era.

UEFA Champions League: Liverpool Stage Another Late Show & Chelsea Endure Loss at Bayern Munich - Key Moments & Responses

By Jennifer Moyer

•

18 Sep 2025

Acclaimed similar to Diego Maradona – could Kevin De Bruyne come back to trouble Manchester City?

By Jennifer Moyer

•

18 Sep 2025

The Kingdom of Saudi Arabia and Pakistan Finalize Mutual Security Treaty

By Jennifer Moyer

•

18 Sep 2025

Family of Black Student Discovered Hanging from Campus Tree Retain Rights Advocacy Attorney

By Jennifer Moyer

•

18 Sep 2025

It has Reached This Point: The Prime Minister Currently Acts as Just the Opening Act for Reform UK's Leader

By Jennifer Moyer

•

18 Sep 2025

Style Sector Faces the Danger Going Backwards Concerning Diversity, States Previous Vogue Boss

By Jennifer Moyer

•

18 Sep 2025

On the Road with the Official Tasked with Justifying Britain’s Controversial Aid Cuts in West Africa

By Jennifer Moyer

•

18 Sep 2025

An Inspired Dish for Lasagna with Zucchini and Cheese Medley

By Jennifer Moyer

•

18 Sep 2025

September 2025 Blog Roll

August 2025 Blog Roll

July 2025 Blog Roll

June 2025 Blog Roll

Popular Posts

Sponsored News

News

News

Trump Hails Kimmel Suspension as TV Stations Replace Broadcast with Conservative Activist Special

By Jennifer Moyer

•

18 Sep 2025

By Jennifer Moyer

•

18 Sep 2025

News

News

Clarks Launches an Exhibition to Celebrate Two Hundred Years of History

By Jennifer Moyer

•

18 Sep 2025

By Jennifer Moyer

•

18 Sep 2025

News

News

Black Rabbit Critique: A Bleak Drama Which Fails to Create Audiences Care

By Jennifer Moyer

•

18 Sep 2025

By Jennifer Moyer

•

18 Sep 2025

News

News

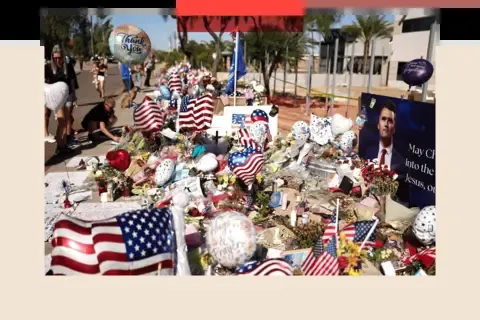

How America Faces a Dangerous Juncture Following the Charlie Kirk Shooting

By Jennifer Moyer

•

18 Sep 2025

By Jennifer Moyer

•

18 Sep 2025

News

News

Sex Abuse Allegations Against Prominent Down Under Broadcaster Downgraded

By Jennifer Moyer

•

18 Sep 2025

By Jennifer Moyer

•

18 Sep 2025

News

News

Trump Aims to Classify Antifa as a Major Radical Group

By Jennifer Moyer

•

18 Sep 2025

By Jennifer Moyer

•

18 Sep 2025